The future belongs to investments in financial services

Invest and secure your future today.

For those who:

Who is considering investing

Who is not interested in income on deposit

Who does not trust banks

Who is interested in earning more

Cooperation with

UM Factoring

We offer investors a new direction of investment. UM Factoring makes profitable investments in products of varying degrees of liquidity and profitability.

The most profitable of them are:

financing in small and medium business

purchase of accounts receivable

To investors

Investments

Companies whose activities are related to investments usually have several sources of financing that are not mutually exclusive and are used simultaneously. The management of such firms develops a development strategy and selects areas where they are ready to invest money.

Increasingly, such enterprises invest in factoring firms that do not depend on market instability and other indicators. Investments in this case go to finance the company, which earns on contracts with deferred payments and receivables management.

manage public and municipal debts

Opportunities of the factoring company

Conducting a thorough analysis of the market and the sphere of activity of companies where investments can be directed;

Registration of collateral, which UM Factoring specialists carry out in accordance with the legislation of Ukraine;

Receive passive income from 10% per annum in US dollars.

By investing in UM Factoring, the investor receives a stable passive income.

UM Factoring guarantees the provision of reliable information about the activities and distribution of finances.

We offer investors a new direction of investment

UM Factoring makes profitable investments in various industry areas with different degrees of profitability

The most profitable of them are:

financing in small and medium business

purchase of accounts receivable

manage public and municipal debts

UM Factoring makes profitable investments in various industry directions with varying degrees of profitability.

1657

%

Net income growth rate for the last three years

976

%

Net profit growth rate for the last three years

43

%

Growth rate of asset value over the last three years

General performance indicators of UM Factoring

Throughout the whole period the net working capital of UM Factoring (calculated as the difference between current assets of UM Factoring and its current liabilities) is steadily growing.

The value of this indicator indicates that UM Factoring has sufficient current assets to repay current liabilities and expand further activities.

.jpg)

Liquidity ratio

The liquidity of the company shows the ability to convert available assets into cash to make the necessary current payments, timely repayment of its debt obligations.

Total liquidity ratio:

Indicates the sufficiency of the company's resources that can be used to repay its current liabilities (calculated as the ratio of current assets to current liabilities of the company). During the period, the value of this indicator decreased from 27.03 in 2017 to 6.07 in 2021 (the norm is >1.0).

As at 31.12.2021, the total liquidity ratio is 6.07. The value of the ratio indicates the sufficiency of the Company's resources that can be used to repay its current liabilities. The Company is able to repay 100% of its current liabilities at the expense of current assets.

Absolute (term) liquidity ratio:

Characterizes the part of current liabilities that can be paid immediately (calculated as the ratio of cash and cash equivalents and current financial investments to current liabilities). During the period, the value of this indicator was in the range from 0.09 to 0.5 (norm >0). As at 31.12.2021, the absolute (term) liquidity ratio is 0.16. The value of the ratio indicates the ability of UM Factoring to immediately repay 16% of its current liabilities.

During the entire period of existence of UM Factoring LLC, liquidity indicators exceed the normative level, which indicates the solvency of UM Factoring. UM Factoring has enough current assets to repay current liabilities and expand further activities. Regarding the decrease in the value of total and current (quick) liquidity ratios during the period under review, it should be noted that too high liquidity ratios indicate inefficient use of UM Factoring capital for the formation of unproductive assets. Thus, the reduction of these indicators is positive and is associated with the optimization of the use of UM Factoring assets.

Current (quick) liquidity ratio:

Reflects the payment capabilities of UM Factoring to pay current liabilities in case of timely settlements with debtors (calculated as the ratio of the most liquid current assets (cash and cash equivalents, current financial investments and accounts receivable) to current liabilities of UM Factoring). During the period, the value of this indicator decreased from 27.03 in 2017 to 6.07 in 2021 (norm >0.6-0.8).

As of 31.12.2021, the current (quick) liquidity ratio is 6.07. The value of the ratio indicates the ability of UM Factoring to pay 100% of its current liabilities subject to timely repayment of receivables.

Throughout the entire period of existence of "UM FACTORING" LLC, liquidity ratios exceed the normative level, which indicates solvency.

UM Factoring has sufficient current assets to repay current liabilities and expand further activities.

Regarding the decrease in the value of total and current (quick) liquidity ratios during the analyzed period, it should be noted that too high liquidity ratios indicate inefficient use of UM Factoring capital for the formation of unproductive assets.

Thus, the decrease in these indicators is positive and is associated with the optimization of the use of UM Factoring assets.

Conclusion:

Based on the analysis of the above indicators, it can be concluded that "UM FACTORING" LLC has a satisfactory financial condition, is solvent, liquid and financially stable.

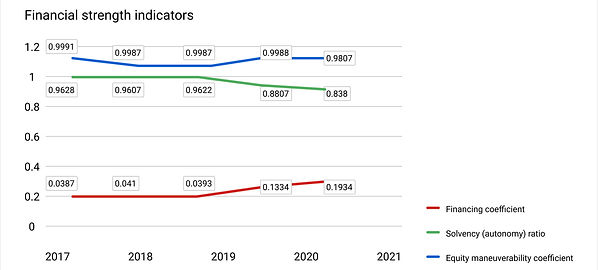

UM Factoring has enough current assets to repay current liabilities and expand further activities. UM Factoring LLC has a high level of financial stability and does not depend on external sources of financing. Financing of the company's activities is provided by its own capital. The activity of UM Factoring is profitable, while over the past three years the efficiency of the company's economic activity has been steadily increasing.